What’s Choices Trade? Simple tips to Change Possibilities

Therefore, options might be complementary in order to carries on your own portfolio. When investors merge both along with her, he’s got much more options than whenever they traded carries alone. Options is also operate just like an agenda, Callahan demonstrates to you. Such as, if the an inventory you possess minimizes inside really worth, to shop for certain kinds of possibilities may help cancel out any potential losings on your own offers. If you’ve popped to the alternatives exchange bandwagon over the past season, you are not by yourself.

Customer Be mindful

This really is a living creating choices strategy which involves offering (writing) a put choice on the an inventory and possess the cash inside your account to buy the newest inventory in case your choice is exercised. Think about, whenever offering a put choice, you are attempting to sell the right to sell and you may and so you are assure that you happen to be a buyer away from an inventory in the a set rate (the newest hit price) in case your option is exercised. The new display price of Acme Firm truly does surge large inside rates and in 3 months offers is trading to possess $90.

People must prefer a specific hit rate and conclusion time, and this locks on the rates they feel an asset is actually going for the more a particular timeframe. Yet not, they also have the flexibleness to see exactly how something workout in those days—and if it’re incorrect, they’re maybe not obligated to actually play a swap. You could potentially deploy a range of alternatives trade steps, from an easy approach to detailed, difficult positions. But generally speaking, exchange phone call options is where you bet on rising prices if you are exchange put possibilities try a method to wager on losing rates.

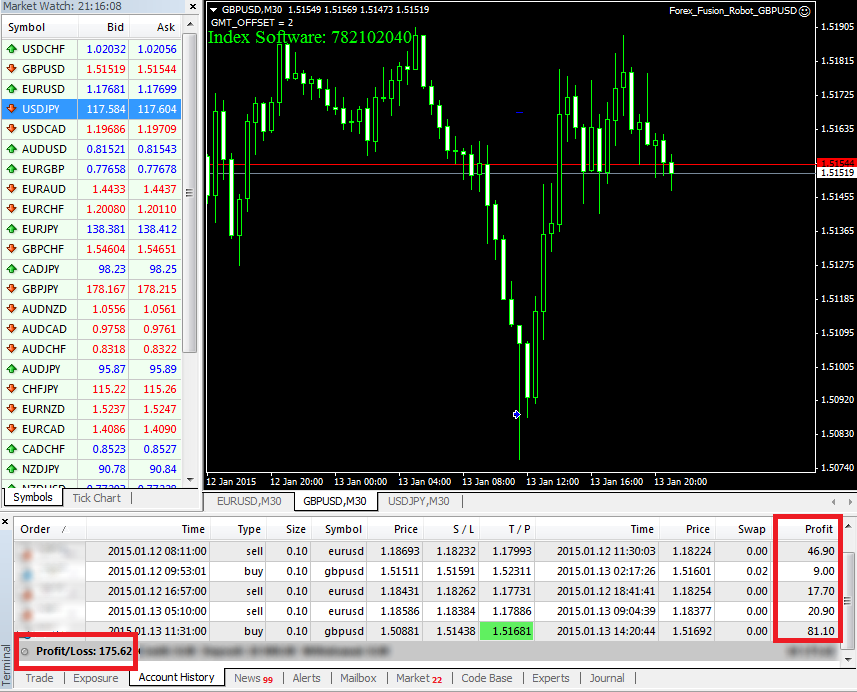

Options change system devices analysis

Therefore, the new desire to own options traders is they tends to make a lot more within the percentage words than simply they can by buying the newest stock. Such as, If the inventory increases of $20 to $twenty five during the termination, then your stock buyer will have earned a 25 % profit. At the same time, the options buyer in this analogy will have earned a return out of eight hundred % (a good $eight hundred gain divided from the $100 prices), perhaps not factoring from the cost of people income. If the inventory rates ends conclusion above the struck rates, the phone call option is in the money. Above the struck price, all $step one dollar escalation in the brand new inventory rate translates to a $a hundred acquire on the worth of the choice. Such, since the inventory actions away from $23 to $24, the option really worth motions away from $three hundred in order to $400, otherwise an increase of 33 percent.

Alternatives Trading Told me: An amateur’s Publication

Meanwhile, the possibility https://labortest.com.py/7-greatest-crypto-transfers-in-the-usa-2025/ blogger would be allotted to provide the underlying inventory from the strike price if the an option they offer (write) is actually worked out. Frederick says most shielded calls can be purchased out of the money, and this generates income quickly. In case your inventory falls slightly, goes sideways, or rises somewhat, the options usually end meaningless and no after that obligations, he states. In case your inventory goes up which is over the strike price when the choices expire, the new stock was entitled out in the an income simultaneously to your earnings achieved if possibilities was marketed.

If you wish to meet or exceed brings, mutual fund otherwise ties in your profile, to find choices would be a great fit. As with any funding alternatives you make, you’ll have a very clear idea of everything hope to to accomplish prior to exchange options. Carolyn Kimball are a former managing editor to own StockBrokers.com and you can AdvisorSearch.org (previously buyer.com). Carolyn features more than 20 years out of writing and you may modifying feel in the significant media outlets along with NerdWallet, the fresh Los angeles Minutes plus the San Jose Mercury News. Blain Reinkensmeyer, direct away from research in the StockBrokers.com, could have been investing and you can change for more than 25 years. After that have placed over 2,one hundred thousand trades within his later kids and you may early twenties, the guy turned one of the first inside the electronic media to review on the internet brokerages.

Of these attempting to trading locations using computers-energy because of the programmers and builders. The fresh projections or other guidance created by the attention Calculator equipment try hypothetical in general, don’t mirror actual overall performance and therefore are not promises of upcoming results. If you have a free account-certain matter otherwise concern, delight contact Customer Features. To own specific platform views and you may suggestions, delight fill in it right to we using these instructions. Talking about delivered to account control and you will standard financial motives.

Gamma is actually high to own alternatives that will be at-the-money minimizing for choices that will be inside the- and you will away-of-the-money, and accelerates inside magnitude because the conclusion techniques. Western possibilities will likely be worked out any time involving the day from purchase and the termination time. Eu possibilities will vary from Western options for the reason that they are able to only become resolved at the end of their existence on their expiration date.

It’s a step a lot more than simply to shop for holds otherwise list finance to have long-name progress, however it doesn’t bring the brand new high risk out of much more speculative leveraged choice actions. Which transaction forms the full “controls.” Should your call is actually worked out and also the offers are known as aside, you can start again by the offering other set. Change to your margin is just for knowledgeable investors with high risk threshold. For more information from the prices for the margin money, delight discover Margin Loan Rates.

How much money Do you wish to Trading Choices?

Theta increases when choices are at the-the-money, and reduces whenever options are inside the- and you may away-of-the cash. Brief phone calls and brief sets, simultaneously, features confident Theta. By comparison, something whose really worth isn’t eroded by-time, for example a stock, provides no Theta. Possibilities spreads is actions which use various combinations of purchasing and you may selling different choices on the wanted chance-return profile. Develops try created having fun with vanilla extract choices, and will take advantage of various conditions for example higher- or reduced-volatility surroundings, up- otherwise off-motions, otherwise something in the-ranging from.